- #FREE INVOICE GENERATOR GENERATOR#

- #FREE INVOICE GENERATOR MANUAL#

- #FREE INVOICE GENERATOR FULL#

- #FREE INVOICE GENERATOR SOFTWARE#

- #FREE INVOICE GENERATOR DOWNLOAD#

No more handoffs and physical document routing by post, hoping it would reach its destination. Online collaboration leads to improved staff productivity. Plus, generating an invoice and sending it online is done in minutes. What are some benefits? Less data entry and paper handling, better document management, and safe digital storage. This aversion to electronic invoicing is rather emotional than rational.īut the good news is that SMBs are expected to adopt large-scale business automation-especially invoicing-in their business processes by 2026. Plus, some invoicing solutions are costly.

#FREE INVOICE GENERATOR SOFTWARE#

Freelancers and small business owners not opting for electronic invoicing do so because of their perceived difficulty in adopting new software (problem: bumpy onboarding) and managing a new tool (problem: the need for some technical training). Let me tell you that there are no real cons to electronic invoicing. What gives? Why the resistance to digital or electronic invoicing? That means that in 2019 only 55 of the 550 billion invoices were exchanged without relying on paper. Statistics ( Billentis, 2019) show that only 10% of data entry/extraction in invoicing is done electronically worldwide. So, by automating administrative activities, businesses could save up to $2 trillion in yearly wages since almost half (45%) of such tasks could be done faster and cheaper with better processes and software, according to a McKinsey study. Research shows that there is just too much administrative work – this lost productivity accrues on average 69 work days and $5 trillion in annual wages. However, the market is estimated to surpass $25 million by 2027 regarding software and invoicing solutions. In 2017, the electronic invoicing market was barely scratching, with 88% of SMBs trying to spend less than $100/month on an invoicing tool. Notes/Terms – includes any necessary comments.Itemized list – a breakdown of your services detailing the units, quantity/hours, and price (with or without taxes and discounts).Invoice dates – delivery (when you provided the services), date (when you generated the invoice), and due date (payment deadline).Invoice name & number – a logical sequence for invoice tracking.Customer info – includes the relevant Client Info.

#FREE INVOICE GENERATOR FULL#

#FREE INVOICE GENERATOR DOWNLOAD#

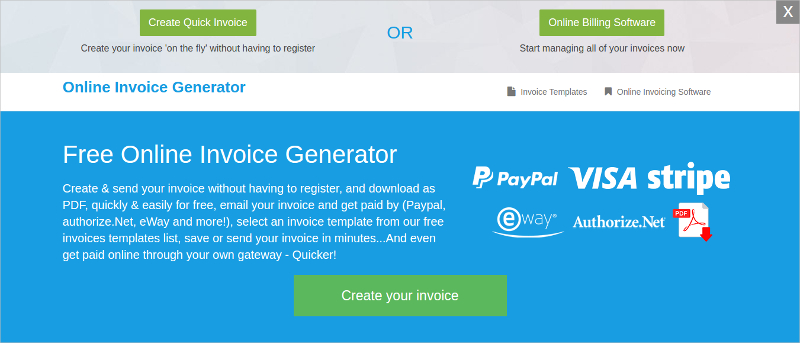

Third, you download your invoices to the cloud. Second, you send the invoice to your client and receive payment through an online payment gateway or ACH.

#FREE INVOICE GENERATOR MANUAL#

First, you generate your invoice electronically by filling out your data with little manual input.

#FREE INVOICE GENERATOR GENERATOR#

Invoice Generator – Super straightforward but filled with pop-ups and banners Free Invoice Builder – Easy and intuitive but sometimes glitchy Invoice Home – Robust invoice generator with an old-school interface Invoice2Go – Simple invoice generator with basic customization features Invoice Owl – Easy and clean interface but somewhat unreliable Refrens – Invoice generator with one too many custom fields Payment options and details (e.g.Jump to the free online generator reviews:.There are a few more things you can add to an invoice to make them more helpful to customers: The amount of GST added (for tax invoices).The seller's name (this could be your business or personal name).

0 kommentar(er)

0 kommentar(er)